Matthew J. Previte Cpa Pc Can Be Fun For Everyone

Matthew J. Previte Cpa Pc Can Be Fun For Everyone

Blog Article

The Main Principles Of Matthew J. Previte Cpa Pc

Table of ContentsMatthew J. Previte Cpa Pc Fundamentals ExplainedA Biased View of Matthew J. Previte Cpa PcSome Known Details About Matthew J. Previte Cpa Pc Everything about Matthew J. Previte Cpa PcMatthew J. Previte Cpa Pc for BeginnersWhat Does Matthew J. Previte Cpa Pc Do?

Tax obligation regulations and codes, whether at the state or federal level, are also made complex for a lot of laypeople and they transform frequently for several tax professionals to stay up to date with. Whether you just need a person to assist you with your company earnings tax obligations or you have actually been billed with tax obligation fraudulence, employ a tax lawyer to help you out.

The 2-Minute Rule for Matthew J. Previte Cpa Pc

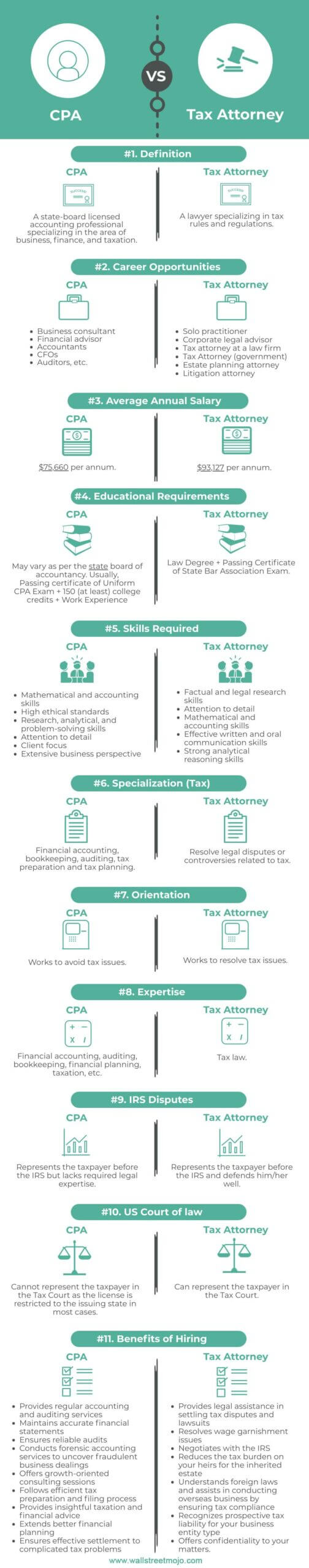

Every person else not only dislikes dealing with tax obligations, yet they can be outright worried of the tax companies, not without factor. There are a couple of concerns that are always on the minds of those that are managing tax obligation problems, including whether to hire a tax obligation lawyer or a CPA, when to employ a tax attorney, and We intend to help answer those questions right here, so you know what to do if you discover on your own in a "taxing" scenario.

A lawyer can stand for clients before the IRS for audits, collections and allures but so can a CERTIFIED PUBLIC ACCOUNTANT. The huge difference here and one you need to bear in mind is that a tax legal representative can supply attorney-client privilege, indicating your tax attorney is exempt from being obliged to indicate against you in a law court.

3 Simple Techniques For Matthew J. Previte Cpa Pc

Or else, a CPA can affirm versus you even while helping you. Tax obligation attorneys are extra aware of the various tax obligation negotiation programs than most Certified public accountants and understand just how to pick the very best program for your situation and how to get you gotten approved for that program. If you are having a trouble with the IRS or just questions and problems, you need to employ a tax attorney.

Tax Court Are under investigation for tax fraud or tax evasion Are under browse around this site criminal investigation by the internal revenue service Another important time to employ a tax attorney is when you obtain an audit notice from the internal revenue service - Unfiled Tax Returns in Framingham, Massachusetts. https://sandbox.zenodo.org/records/41508. A lawyer can communicate with the internal revenue service on your behalf, exist during audits, assistance bargain negotiations, and maintain you from paying too much as an outcome of the audit

Part of a tax obligation attorney's obligation is to maintain up with it, so you are secured. Ask about for an experienced tax obligation lawyer and check the web for client/customer testimonials.

What Does Matthew J. Previte Cpa Pc Mean?

The tax lawyer you have in mind has all of the appropriate credentials and testimonies. Should you hire this tax attorney?

The choice to hire an IRS attorney is one that should not be taken lightly. Lawyers can be extremely cost-prohibitive and make complex issues needlessly when they can be solved fairly conveniently. In basic, I am a big advocate of self-help lawful services, especially provided the selection of educational material that can be found online (consisting of much of what I have actually released on taxes).

Matthew J. Previte Cpa Pc - The Facts

Right here is a quick checklist of the issues that I think that an Internal revenue service attorney must be worked with for. Wrongdoer charges and criminal investigations can damage lives and bring very serious consequences.

Bad guy charges can likewise bring additional civil fines (well beyond what is typical for civil tax obligation matters). These are just some instances of the damage that even simply a criminal charge can bring (whether a successful sentence is inevitably gotten). My point is that when anything potentially criminal develops, even if you are just a possible witness to the matter, you require a seasoned internal revenue service lawyer to represent your rate of interests against the prosecuting agency.

This is one instance where you always need an Internal revenue service lawyer viewing your back. There are numerous parts of an IRS lawyer's job that are seemingly routine.

The 45-Second Trick For Matthew J. Previte Cpa Pc

Where we gain our stripes though gets on technical tax obligation issues, which placed our complete ability to the test. What is a technical tax problem? That is a tough question to respond to, yet the most effective method I would certainly describe it are matters that call for the professional judgment of an IRS lawyer to resolve effectively.

Anything that has this "truth reliance" as I would certainly call it, you are mosting likely to desire to generate an attorney to speak with - Due Process Hearings in Framingham, Massachusetts. Also if you do not maintain the solutions of that attorney, an experienced viewpoint when dealing with technical tax issues can go a lengthy means toward comprehending concerns and solving them in an appropriate way

Report this page